An alternative credit score may consider expenses and obligations that a traditional score don’t include. But first things, first. When was the last time you checked your credit score? If you saw a number that you didn’t like, did you do anything about it?

Our modern systems rely on credit to allow everyone access to more purchase power. But credit comes in different forms, and some of these are prioritized when factoring your traditional credit score. An alternative credit score, on the other hand, considers expenses and obligations that traditional scores don’t include—many of which are the bills and regular payments you make in daily life. Can an alternative credit report help you look more attractive to lenders?

Understanding Alternative Credit Score and Reports

Credit scoring is bigger than just the big three bureaus. While your traditional credit report is predominantly looking at your major lines of credit, an alternative credit score and report will reflect your regular bills. Some of the payments included are:

- Rent

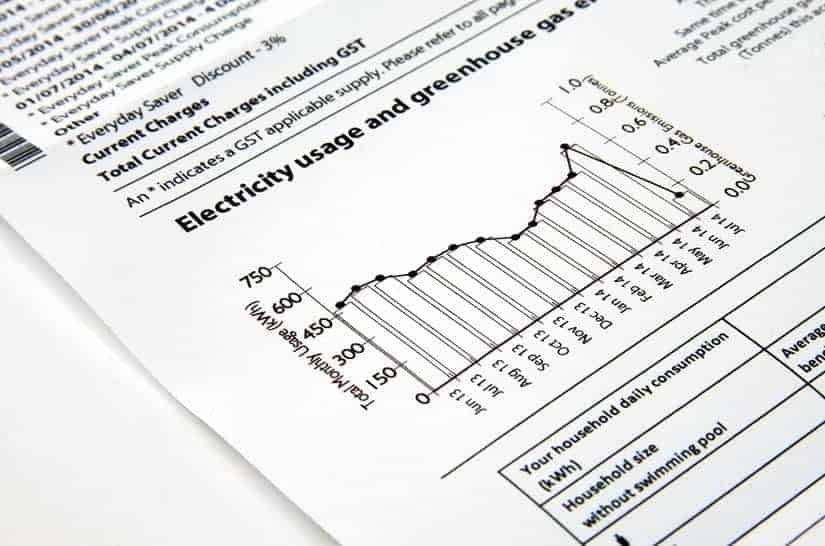

- Utilities

- Internet and phone

- Insurance

- Student loans

You probably pay most of these on a regular basis, so you get rewarded with a higher alternative credit score. However, your alternative credit score and report can’t wipe out or help you ignore late payments and defaults on your traditional score.

When Can You Use an Alternative Credit Score and Report?

Lenders are legally required to look at your alternative credit score and report if you present it to them, according to Consumer Finance Protection Bureau (CFPB) regulations. A number of businesses already accept an alternative credit score, so it is always worth asking a potential lender, whether you’re looking at mortgage loans or store credit cards.

In some cases, lenders will ask for supporting documentation to verify your alternative credit score and report, so it is ideal to pay your bills by check or electronically, making a record easily available. You may also be able to provide information about savings accounts, your income, or even your spending habits to improve your application.

What is Included in an Alternative Credit Report?

Alternative credit reports are not that different from traditional ones, as it is the reporting information that varies the most. However, traditional credit scores range from 350 to 850, whereas alternative scores tend to range from 100 to 850. Despite this, the scores function in the same way—the higher, the better. Both traditional and alternative scores above 750 signal dependability to the lender.

How Alternative Credit Score is Impacting Consumer Finance

It can be hard to get started establishing traditional credit if you don’t have any history to show lenders you are responsible. However, because you can establish alternative credit with the payments you make regularly, you can then provide lenders with sufficient information.

With more people eligible to establish credit, and related increased purchasing power, all industries from housing to retail benefit. Acknowledging that, some companies are making alternative credit scoring a standard part of their application criteria.

In fact, FICO—the predominant credit scoring system—is now incorporating ways to accumulate data for the nearly 15 million Americans whose data doesn’t qualify for traditional scores. The big three credit bureaus have also started changing practices over the last several years to allow for things like rent payment reporting.

It’s time to consider establishing alternative credit to enhance your credit eligibility. Your first step is to check your credit scores to see where you stand. Get started today.