A debt settlement expert or agency is a good choice as managing your own debt settlement can be a process if managed alone. You may be telling yourself that you know how to negotiate credit card debt settlement yourself or that you don’t want anyone else to know about your debt problems. Maybe you’re worried that hiring someone to help with your debt settlement could cost you money and make your financial recovery more difficult.

Though there are many steps you can take yourself, managing your own debt settlement is tricky. A specialist can actually save you money in the long run by bringing experience to the table. A debt settlement expert works with debt collectors on a daily basis and can get the best possible deal on your behalf. A debt settlement expert definitely won’t be critical of you, because he or she has seen all kinds of problems with debt and understands that even the best people can get behind in their payments.

How Does Debt Settlement Work?

When you settle a debt, it means you come to an agreement with your creditors that you will pay them an amount less than the total you owe just to clear the obligation. It’s often only possible after you’ve missed at least 6 months of payments.

You cannot generally settle debts for a physical asset, like a house or car — the creditor will simply foreclose on the property or repossess the vehicle. You also will be unable to settle a student loan debt (the lender will likely put you on a payment plan or garnish your wages).

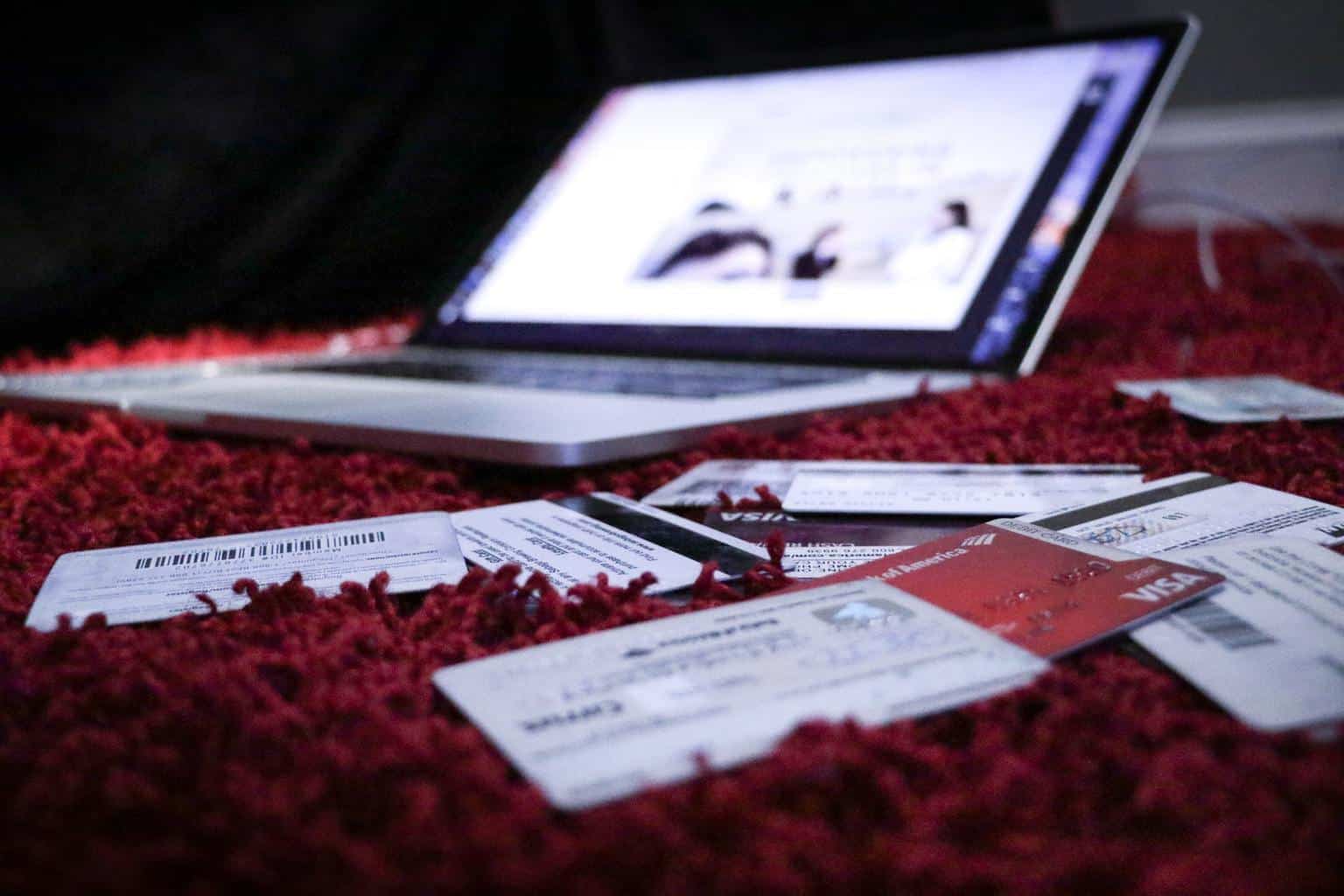

Instead, debt settlement is negotiated for unsecured debt like credit cards or medical bills. In many cases, the debt that you are working to settle has already been sold from the original creditor to a debt collection agency that will threaten to sue you to collect the debt.

What Can a Debt Settlement Company Do to Help Me?

Because debt settlement is neither easy nor fast — it can take years to work through negotiations and get your debt wiped away — it makes sense to hire a debt settlement expert who can walk you through all the obstacles that are part of getting a reasonable debt settlement. An additional benefit is that your debt settlement specialist can manage all of the communication with debtors, so you are no longer harassed with phone calls and threatening letters.

The settlement company is also more likely than you to know what amounts a debtor will settle for. Because they manage many accounts that are in the settlement process, a debt settlement expert may be able to ask for and get a better deal than you would get acting on your own.

Here’s how a debt settlement company works. They have you put a set amount each month into a special account. Once you have enough built up, they can start negotiating with creditors to pay back a reduced amount of what you owe.

Settlement companies earn their money by taking a percentage of your total debt, usually at the time the debtor is paid. Let’s say you have a $10,000 debt, and your settlement professional negotiates that down to $5,000. You’ll pay a percentage — usually between 10% and 25% — of the original amount to the settlement company. So, in addition to the $5,000 that you’ll pay to the original creditor, you could also pay a 20% fee of $2,000 to the settlement agency. Your total paid out is $7,000, which is still considerably less than your original debt. Be sure to understand the fees and when they will be assessed so you’re not surprised.

It’s possible that your debtors will not agree to settle the amounts you owe with a professional debt settlement expert or firm. In that case, most debt settlement companies will not charge you. In other words, they only get paid if they succeed at negotiating with your debtors.

What are the Problems with Debt Settlement?

Just because you settle your debts does not mean that your credit report is restored. You’ll still have delinquent accounts showing on your report, and they’ll remain there for seven years. Your credit score will also be impacted, making it harder to get a mortgage, an auto loan, or an unsecured credit card for that length of time.

You also may not get a net benefit from hiring a debt settlement expert or agency if you only have a small debt or just a couple of accounts that are delinquent. Typically, you would need to have at least four accounts before hiring a debt settlement specialist makes financial sense.

Finally, you may also have a tax burden if the forgiven portion of the debt is considered taxable income. Some debt settlement companies will advise you about this tax concern, but if you have questions, you may need to consult a tax professional for help.

Choosing a Debt Settlement Expert or Company

The best debt settlement expert or agency for you will be open and willing to spend time answering your questions and counseling you on the best ways to eliminate your debt. You should feel that they are looking out for your best interests against your creditors. They should provide regular reports in writing so you can see their progress. With a few exceptions, they should be willing to work with those you owe directly until it’s time to finalize the settlement agreement. Any debt settlement expert or agency should be willing to explain and estimate their fees before you begin working with them.

Having a professional debt settlement expert or company manage your debt settlement process can be extremely helpful so you don’t have to spend the time working with each creditor. You may also benefit financially by getting a better settlement than you could have arranged working by yourself.