Are you struggling to pay your federal income tax bill in full? The IRS extends Offers in Compromise (OICs) to distressed taxpayers to help resolve tax debt. Unlike installment agreements and other forms of relief, though, the application process can be complicated and warrant the assistance of a professional.

Keep reading to learn more about how OICs work, the application process and where to get professional help if needed.

What is a Form 656?

Form 656 (Offer in Compromise) is a proposal from the taxpayer to the IRS requesting a settlement for their unpaid tax debt. If the IRS agrees and accepts the offer, the taxpayer can remit payment for a portion of what they owe to settle the balance in full and avoid further collection activity.

About Offers in Compromise (OIC)

Types of Offers in Compromise

The IRS typically approves OICs in the following situations:

- Doubt as to Collectibility: The taxpayer’s assets and income are insufficient and prevent them from remitting what they owe the IRS within the statutory period.

- Doubt as to Liability: The taxpayer legitimately believes they don’t owe the tax liability assessed by the IRS. In some instances, the taxpayer could also be eligible for an OIC under this premise if the tax liability assessed was incorrect due to an error or misinterpretation of the tax code by the tax examiner. If the tax examiner fails to review the taxpayer’s evidence or counter-claim, the taxpayer could also be granted an OIC.

- Exceptional Circumstances (Effective Tax Administration): The taxpayer faces an extenuating circumstance and can prove to the IRS that paying the tax debt in full would be inequitable, unfair or lead to severe financial hardship.

Who Can Qualify for an Offer in Compromise?

Taxpayers who meet the following criteria could qualify for an OIC:

- The taxpayer has filed all legally required tax returns.

- The taxpayer is current on the required estimated tax payments for the current tax year.

- The taxpayer is not actively involved in bankruptcy.

- The taxpayer has received a bill from the IRS for at least one of the tax debts they want to include in their OIC.

How to Request an Offer in Compromise from the IRS

You can download Form 656 and the instructional booklet directly from the IRS website. More on this below.

Should You Get Professional Help to Request an Offer in Compromise?

The acceptance rate for OICs is low, and it can be challenging to navigate the complex process. Fortunately, tax relief firms provide the professional help you need to create a winning proposal. And if your OIC is denied, tax relief professionals can also assist you with filing an appeal to possibly get the decision overturned.

But if you decide to apply on your own, here are some tips to increase your approval odds:

- Confirm the forms are free of blank spaces and mathematical errors

- Ensure your tax settlement offer is reasonable

- Be sure to file any outstanding tax returns

- Avoid extra tax debt while your OIC application is under review

- Include documentation for the IRS to consider your request in your OIC application

- File an appeal promptly if the IRS denies your initial application

How to Fill Out Form 656 to Request an Offer in Compromise

Instructions to Fill Our Form 656

As mentioned above, the IRS has an instruction booklet online that provides detailed guidance on how to fill out Form 656 and supporting documents.

Supporting Documentation to Form 656

Below is a detailed breakdown of how to apply for an OIC with the IRS:

- Step 1: Collect any financial information you’ll need to complete the forms.

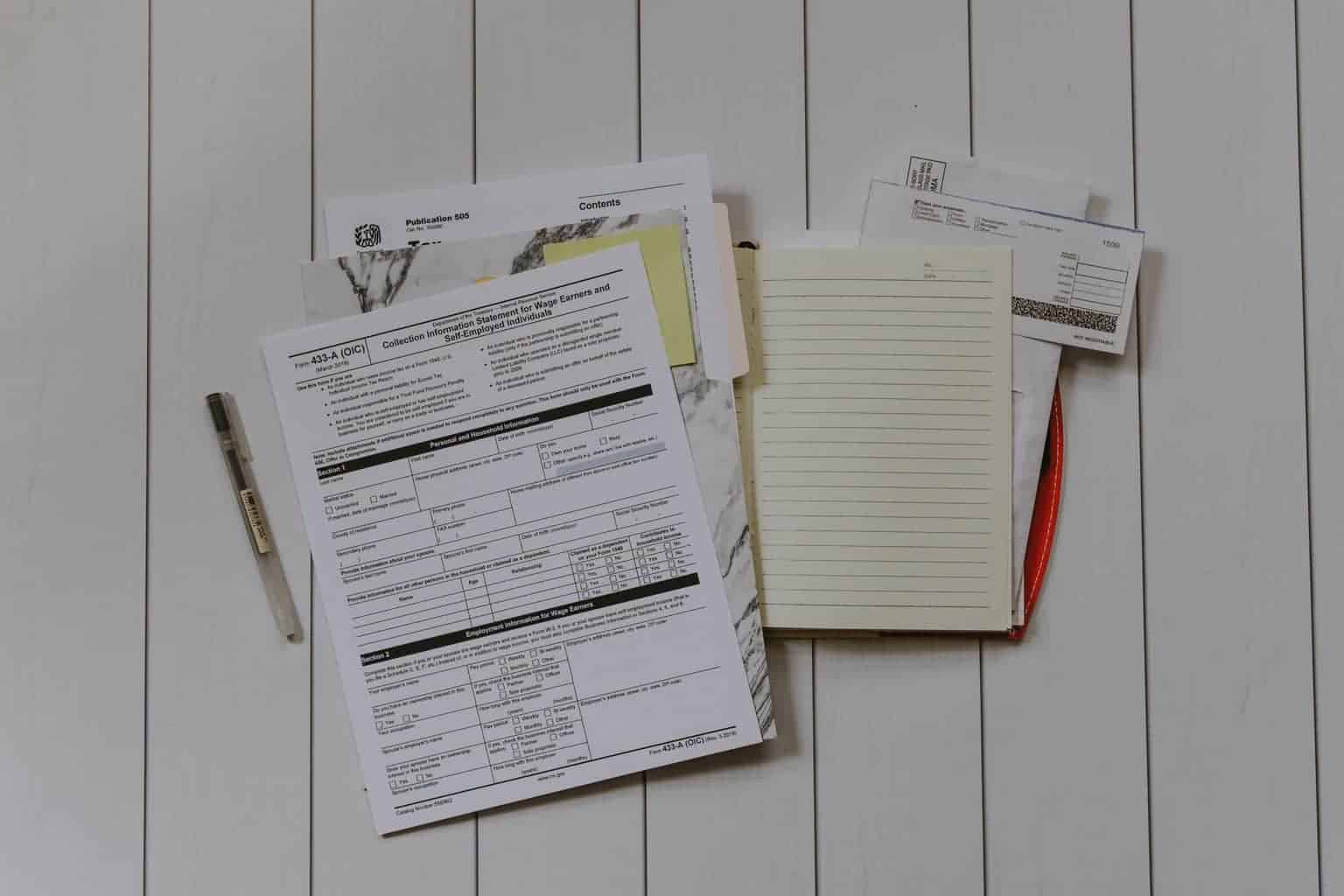

- Step 2: Fill out Form 433-A (OIC) Collection Information Statement for Wage Earners and Self-Employed Individuals. Also, be sure to include any required documentation (if needed).

- Step 3: Fill out Form 433-B (OIC) Collection Information Statement for Businesses. Don’t forget to include documentation required by the IRS (if applicable).

- Step 4: Fill out Form 656 (Offer in Compromise).

- Step 5: Make photocopies of the completed forms.

- Step 6: Gather your documents and send them to the IRS along with the $205 application fee and initial payment. (Quick note: Taxpayers who meet the Low-Income Certifications guidelines are eligible for an application fee waiver).

Use IRS Form 433-A (OIC) to calculate a fair amount for your initial payment. Here’s some additional guidance to help you decide how much you should send with your application and supporting documents:

- Lump-Sum Cash Offer: The taxpayer can pay 20 percent of the proposed settlement amount and the remaining balance in no more than five payments.

- Periodic Payment Offer: The taxpayer makes the first monthly payment that’s equivalent to the amount they’ll pay in subsequent installments until the unpaid tax debt is paid in full.

If your application is denied, you can appeal directly with the IRS by submitting Form 13711 (Request for Appeal of Offer in Compromise).

Submitting Form 656 to the IRS

The mailing address for the IRS depends on your state of residence.

If you live in Arizona, California, Colorado, Hawaii, Idaho, Kentucky, Mississippi, New Mexico, Nevada, Oklahoma, Oregon, Tennessee, Texas, Utah or Washington, send your completed Form 656 and supporting documentation to the following address:

Memphis IRS Center COIC Unit

P.O. Box 30803, AMC

Memphis, TN 38130–0803

Residents of any other state or that reside at a foreign address should send their documents to:

Brookhaven IRS Center COIC Unit

P.O. Box 9007

Holtsville, NY 11742-9007