You received an audit notice from the Internal Revenue Service (IRS) and went into full-blown panic mode. What exactly does this mean, and could you face severe financial consequences? What triggered the tax audit? What information will you need to provide to the IRS? What should you expect during the audit? How far back can the IRS go to audit past returns?

These are all valid questions that we’ll answer in this guide. Furthermore, you can breathe easy knowing there are tax professionals that are available to help you navigate the audit process.

What is an Audit?

The IRS defines an audit as “a review/examination of an organization’s or individual’s accounts and financial information to ensure that information is reported correctly according to the tax laws and to verify the reported amount of tax is correct.”

What Happens in an IRS Audit?

The IRS conducts audits by mail or in person. If the latter is necessary, it will be done in your home or office (if applicable), and you’ll work directly with an IRS agent.

Most IRS audits are wrapped up within two years. However, your timeline could be much sooner, depending on the complexity of the audit and the amount of time it takes you to provide the IRS with the documentation and records needed to move forward with the review.

Your response to audit findings could also impact the timeline. If you agree with the outcome, you can move forward with resolving the outstanding tax liability (if applicable). Otherwise, you have a right to contest a determination, which could delay the process.

What You Need for an IRS Audit

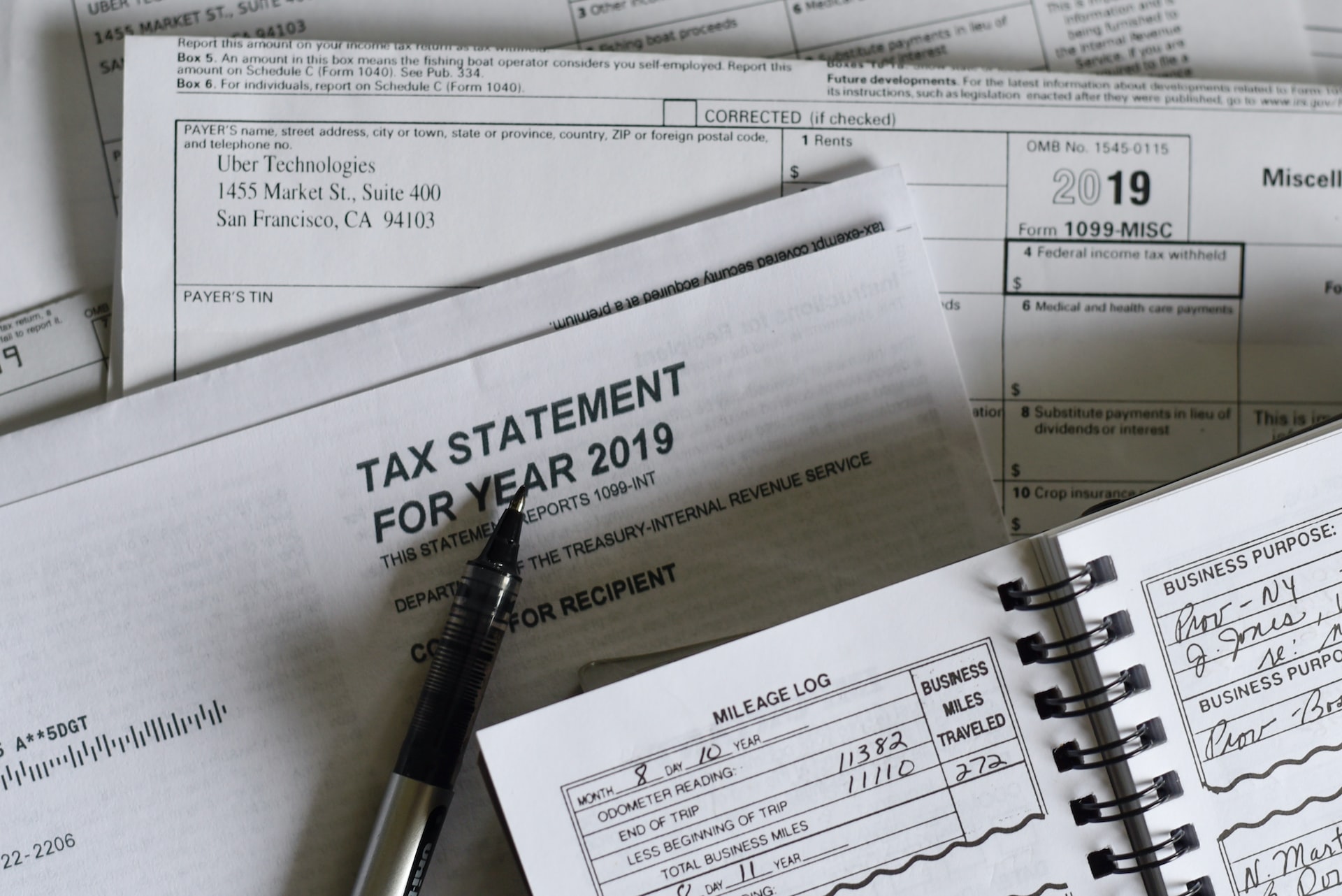

The IRS will send you a written notice detailing the documents you’ll need to provide for the audit. These include receipts, bills, legal documents, loan agreements and canceled checks. Be sure to send copies and retain the originals.

It’s equally important to stow away tax records from the filing data for at least three years, as it’s required by law.

What Are the Common Triggers of an IRS Audit?

The IRS uses two methods to select returns for audit:

- Computer screening and random selection: a statistical formula is used to compare your tax returns to other comparable returns

- Related examinations: your business or individual tax return is chosen because it includes transactions that involve other parties (including investors and business partners) who were also selected for an audit)

Here’s a closer look at common IRS audit triggers:

Failure to Report All Taxable Income

The IRS has a reason to believe that you omitted a portion of your taxable income when you filed a tax return. Copies of your W2 and 1099 forms are submitted to the IRS each year, and discrepancies could result in an IRS audit to confirm or disprove the accuracy of the contents and determine if you owe additional tax.

High Income

You’re considered a high-income earner or a taxpayer who earns $10 million or more. The probability of being audited if you fall into this category is four times higher than taxpayers who earn between $1 million and $10 million and eight times higher than those with earnings below $1 million.

Large Charitable Deductions

The reported amount of charitable contributions is high compared to your earnings. Monetary contributions are cut and dry in terms of valuation – the amount of the check is what you write off. It isn’t so simple with items you donate, though, as it’ll be up to you to claim the right amount on your tax return to avoid issues should you be selected for an audit. But you can hire a professional appraiser to do the legwork for you to avoid any issues with the IRS.

Excessive Deductions

You took a sizable amount of deductions compared to others with comparable incomes or that are in your tax bracket. Of course, it’s possible that you’re entitled to those deductions, but the IRS may decide to take a more in-depth look just in case.

Earned Income Tax Credit

You claimed the earned income tax credit (EITC). Unfortunately, this credit is often claimed fraudulently, so the IRS will audit returns in an attempt to deter dishonest taxpayers from committing tax fraud.

Mathematical Errors

A math error is present in your return, and the IRS identifies it through a screening or examination. The IRS could audit you even if the error works in your favor.

Self-Employment

If you’re a self-employed taxpayer filing a Schedule C, your likelihood of being audited by the IRS is also much higher than a traditional employee. This is due to the many loopholes self-employed taxpayers can use at tax time to understate income or tax extra write-offs to minimize their federal income tax liability.

Business Deductions

There are far too many to list here, so the focus will be on the business deductions that are most likely to trigger an IRS audit. Home office deductions, commercial vehicle deductions, business travel deductions and both meals and entertainment deductions could get the attention of the IRS.

Hobbies

The IRS has strict rules regarding entities and if they should be classified as a hobby or a business for tax purposes. It’s not uncommon to spend more than you earn when you’re just starting out with your new venture. However, you should turn a profit in at least three of the first five years for your operation to be considered a business in the eyes of the IRS.

How Far Back Can IRS Audit Returns?

IRS audits generally don’t go back more than three years. However, the statute of limitations is six years if needed.

The Three-Year Audit

In most instances, the IRS will only review returns filed in the past three years.

The Six-Year Audit

If the IRS uncovers what’s referred to as a “substantial” error, the audit may go back up to six years.

No Time Limit Audit

The statute of limitations does not apply to taxpayers who failed to file or sign tax returns or filed fraudulent returns. This is also the case if you receive foreign gifts, inheritances or income over $100,000 and fail to file Form 3520 (Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts).

Frequently Asked Questions

Here are some frequently asked questions related to IRS Audits.

There’s no surefire way to shield your tax return from an audit. However, you can hire a professional tax preparer or CPA to complete and file your returns for you. Doing so minimizes the chances of your returns containing errors, omissions or other entries that could catch the attention of the IRS and put you in the hot seat.

Yes, the IRS is permitted to audit your tax return for two or more consecutive years if the need arises. However, an end result that’s in your favor, or a “no change letter,” generally means they won’t continue to audit you on the same issue.

You should keep your business records and related documents in a safe place for at least seven years. That way, you’ll have them handy should the IRS decide to audit you. It’s also helpful to maintain adequate records for this timeframe in case you need to amend your return.

In most instances, taxpayers who undergo audits are subject to penalties and interest if the IRS doesn’t rule in their favor. However, there are more serious situations that could be even more costly for the taxpayer and result in criminal charges that come with jail sentences.

Not quite. The reality is most taxpayers will never hear from the IRS regarding an audit. In fact, the likelihood of being audited is under 1 percent, which is good news for you. But there’s also a possibility that you’ll be audited more than once in your lifetime.