Smart Credit

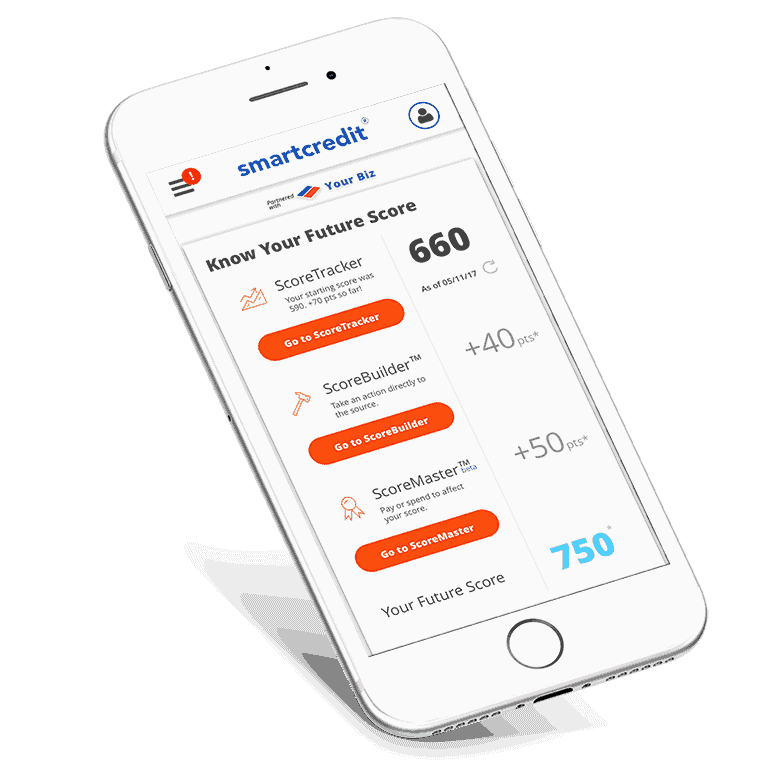

Are you a Score Tracker, Builder or Master?

Sign up for Smart Credit today and gain access to a suite of Credit improvement tools, from monitoring of your purchases to what steps you can take to improve your credit.

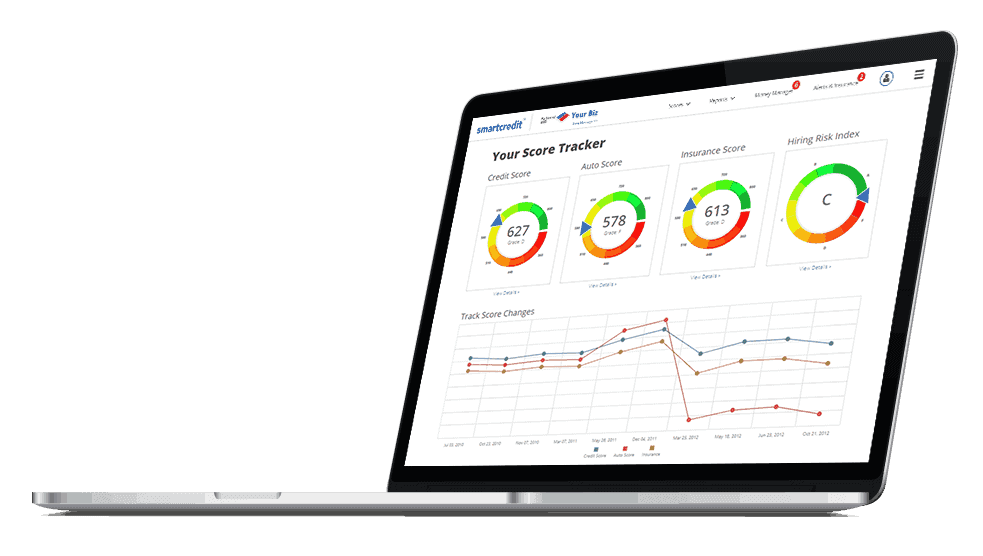

About ScoreTracker

See all your different types of credit scores and see how they’re progressing.

Different Scores

Get an in-depth look at the different types of scores you have and see where you stand.

History

Look at how your scores have changed over time to get a better understanding.

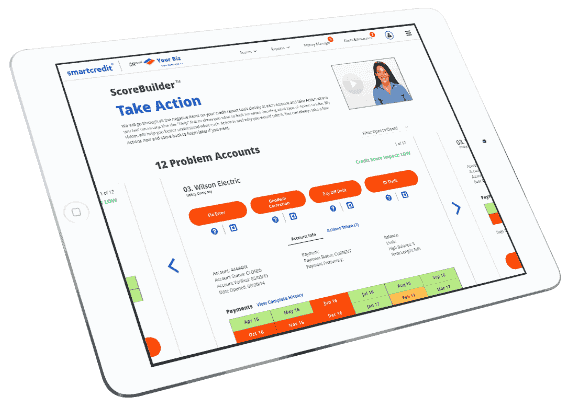

About ScoreBuilder

A unique 120-day plan to help build yourself a better credit score.

Your Personal Plan

ScoreBuilder™ creates a personalized 120-day plan to help you understand what is hurting and helping your credit score, plus what actions you can take.

Take Action

View your negative accounts weighing down your score and take action to take care of them.

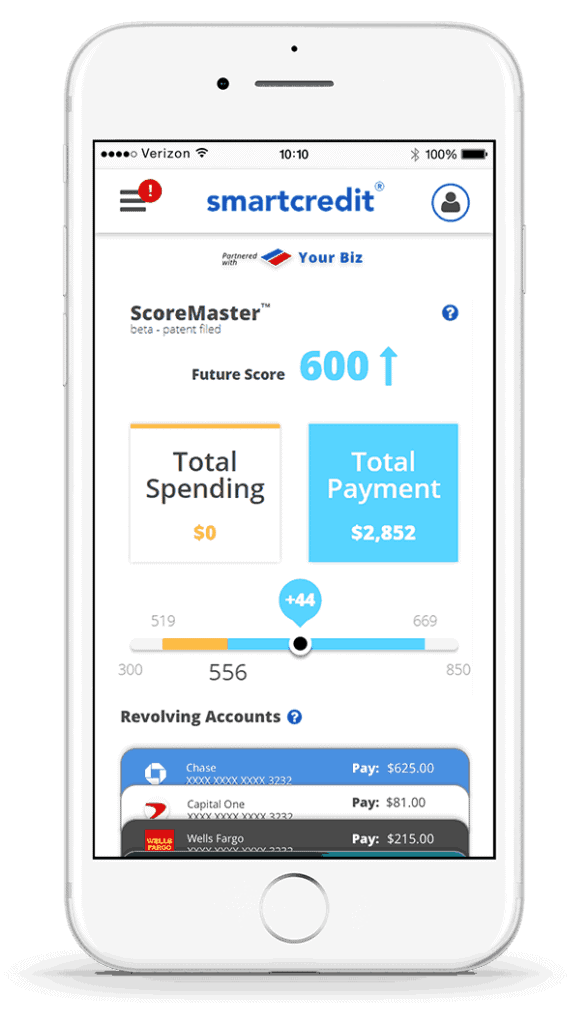

About ScoreBoost

Know your future score before you apply, pay or spend.

Timing

Know the optimum time to apply for a credit card, auto loan, mortgage or other credit.

Spending

See how your spending can lower your credit score. Balance the spending between your accounts and know the optimum time to repay.

Payments

See how your payments can increase your credit score. Know how much to pay and by when.

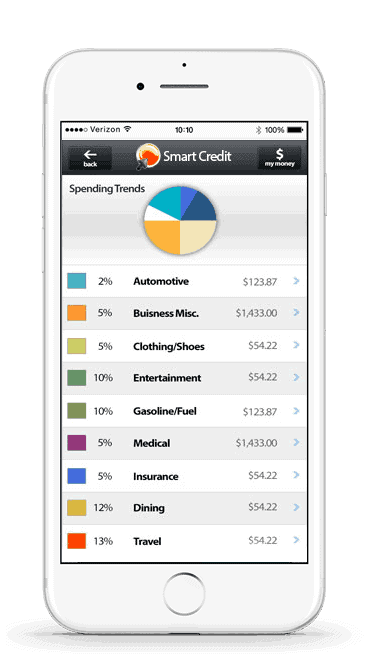

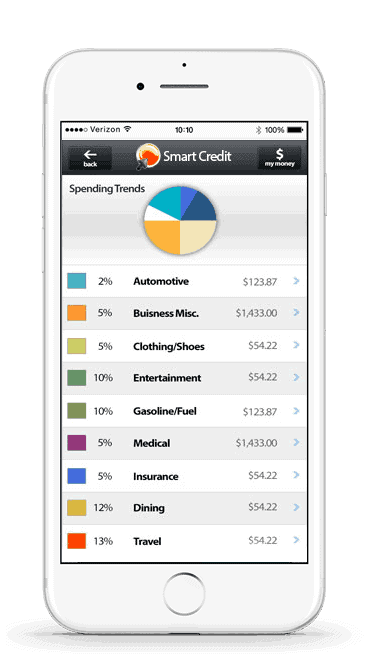

Money Manager

Manage all your online accounts in one place. We track and update your account statements, payments due and transactions every day. Use action buttons to ask questions and resolve problems.

We Find Your Accounts For You

We automatically find your online accounts, making it easy to add to Money Manager. No guessing or searching.

Daily Updates

Your transactions, instant statements, and trends are updated every 24 hours.

Transaction Monitoring Alerts have Action Buttons

Verify transactions are yours and not theft. Stop theft with the action button.

Other Benefits

Receive Alerts when payments are due. Easily plan your budget and spending. Your transactions are integrated with your Smart Credit Report® for the complete picture.

Easily Take Action

Ask your bank or credit card company for anything with a click of a button.

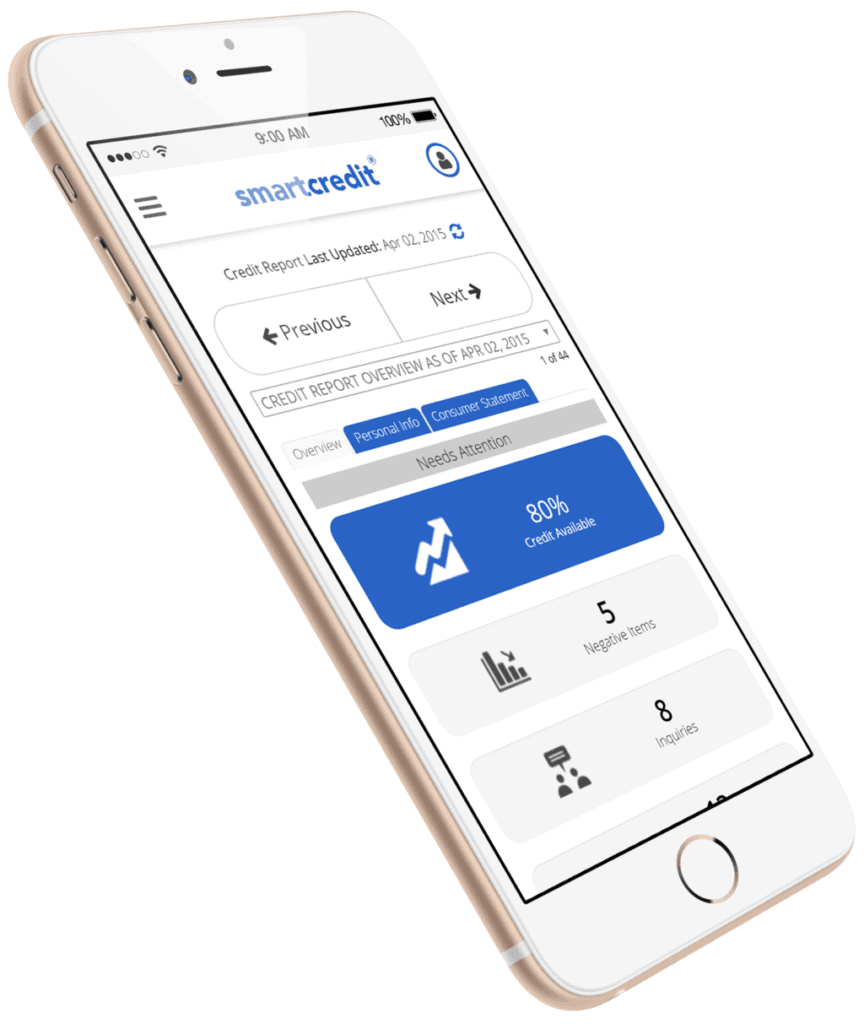

Smart Credit Report

A simple and innovative way to view your credit report.

Use Action Buttons

With a simple button you can remove identity theft, negotiate debts, resolve reporting problems and ask questions directly with your creditors. No forms to fill out, letters or phone calls.

Daily Transaction

For the first time your daily transactions are integrated in to your credit report. See how your creditors are reporting to ensure accuracy.

Credit Monitoring Alerts

Get important Alerts with changes to your credit report by phone or email.

Credit Score

Your credit score ranges from 300 to 850 and is an overall view of your credit history, which is important to lenders.

Auto Score

Auto lenders do not use your Credit Score. They use an Auto Score to better determine your lending risk.

Insurance Score

This score is weighted to risk & stress factors most insurance companies use when looking at your credit.

Alerts & Insurance

Use the action button in your Alerts to quickly react to identity theft. Use your insurance to claim reimbursement, if necessary.

What You Can do with a Button

- Quickly inform your bank or creditor of an unauthorized transaction.

- Quickly respond to an unauthorized account activated in your name.

- No filling out lengthy police affidavits or forms.

- Avoid a lengthy bank or creditor process.

- No transfers to third-party credit repair organizations.

- No lengthy phone calls or writing letters.

Privacy & Fraud Insurance

*Activation Required

PrivacyMaster

- Instruct websites & data brokers to remove your info from their websites.

- Though your information may be removed from a site, it could reappear.

- Get alerted when your data has been removed and if it reappears again in the future.

$1 Million Identity Fraud Insurance

- Zero Deductible.

- Covers your entire family residing in your household.

- Covers your Bank, Savings, Brokerage, Lines of Credit, Credit Card, and more.

- Covers your cash out-of-pocket expenses incurred in your ID recovery.

- Covers your Credit Reports.

- Covers pre-existing Identity Fraud you didn’t know about.

- Replacement cost due to stolen Driver’s License or Passport.

Membership Benefits

- Smart Credit Report:

- Credit Scores:

- Actions:

- Alerts:

- Money Manager:

- 3-Bureau Report & Scores:

- $1MM ID Fraud Insurance:

Protect

$9.99/mo

- 2/mo updates

- 2/mo updates

- 5/mo

- Unlimited

- Unlimited

- A La Carte

- Included (activation required)

Build

$15.99/mo

- Unlimited

- Unlimited

- Unlimited

- Unlimited

- Unlimited

- A La Carte

- Included (activation required)