Stenn offers revenue-based financing for companies that need access to additional capital. This financing method offers flexible payments based on a percentage of future gross revenue and helps businesses address various challenges. The monthly payments for revenue-based financing depend on your company’s growth.

Busier seasons will result in higher payments since your business is generating more revenue. However, you will have lower monthly payments during slower cycles or if business trends outside of your control impact operations. For instance, disruptions in global supply chains can hurt total sales. The flexibility of a revenue-based loan can keep businesses afloat. Stenn makes this financing accessible to e-commerce and SaaS companies.

Who is Stenn? Revenue-Based Business Funding

Stenn is a fintech company based in London that has distributed more than $20 billion in capital to companies in need of financing. The firm is backed by financial institutions like HSBC, Citi, and others. It’s an alternative source of working capital for small and medium-sized businesses that can’t qualify for traditional business loans or need a more flexible payment plan.

What Does Stenn Do?

Stenn Technologies offers revenue-based financing for small businesses in the e-commerce and SaaS markets. This extra capital allows companies to pour more money into their advertising, new hires, inventory, and other business expenses.

Some companies use alternative financing methods to access capital due to credit score requirements, to avoid higher monthly payments in the beginning, and for other reasons.

What Does Stenn Offer?

Revenue-Based Financing

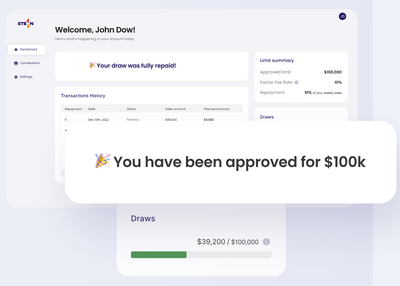

Stenn’s revenue-based financing offers a more convenient way for small and medium-sized enterprises to access capital and pay back debt. Instead of fixed monthly payments, you only make payments that you can afford based on your company’s gross revenue.

Stenn Revenue-Based Business Funding Process

These are the key components of Stenn’s funding process.

Account Creation and Assessment

You will have to create a Stenn account to submit a funding application. You only have to provide your name, email, and password for this part. You also have the option to create an account with Google.

Invoice Submission

Stenn will request several documents, such as your invoices and accounting software, to gauge how much your business earns.

Agreement Signing

Stenn will review your information and offer terms for revenue-based financing. You should review the document before signing the agreement.

Funding

You will receive your funds, which you can use to grow your company and maintain operations.

Repayment

Stenn will receive a percentage of gross revenue as specified in the agreement document. The fintech company will continue to collect proceeds until the agreed amount is fully covered.

What Documents and Information are Needed?

You will have to provide information on the following during the application process:

- Your business’ operating bank account

- Your company’s accounting software and sales platform

- Basic documents like your ID and EIN

Stenn streamlines this process with Codat and Plaid to connect your company’s data securely.

What Can You Use the Funds For?

Revenue-based financing gives you business capital that can cover any purchase. Some of the costs you can cover with financing are advertising, commercial property, and salaries. It is a good idea to create a plan for how you intend to use the funds. Quickly deploying capital into critical initiatives can help you generate a return on your investment sooner.

What are the Fees for Stenn?

Stenn’s fee is a percentage of gross revenue each week or month, depending on how often the owner prefers to pay.

What are the Benefits of Stenn?

These are some of the benefits you’ll enjoy if you use Stenn:

- Flexible monthly payments based on your company’s revenue

- Get extra financing to improve liquidity and invest in marketing

- No collateral required

- Quick application process

- Receive funds in as little as 48 hours after getting approved

Are There Any Risks in Using Stenn?

Every fintech company has strengths and weaknesses. These are some of the risks to keep in mind:

- The possibility of paying far more than you borrowed if your business grows revenue at a substantial pace during the initial months of the contract

- An extra financial obligation

- Losing a percentage of gross revenue can hurt businesses with tight profit margins

How Does Stenn Compare?

Stenn offers a competitive revenue-based financing solution for e-commerce suppliers and software companies that offer digital services. While other fintech firms offer this service for more business segments, Stenn has specialized in a small subset. The lender has given out more than $20 billion in capital and has received financial backing from some of the largest banks.

Who is Stenn For?

Stenn is for e-commerce and SaaS business owners who need extra money but lack enough cash flow to support fixed monthly payments from a traditional business loan. Some startup founders in that position end up refinancing their small business loans to reduce the monthly payments, which creates additional headaches and leads to additional closing costs.

The fintech company is also a great choice for businesses with fluctuating revenue that need a flexible way of making payments. Not every startup can afford regular loan payments when they have slower seasons, or their top-selling product loses momentum. Lower monthly payments during slower cycles give business owners more time to think of new revenue streams and discover opportunities to turn the business around.

Is Stenn Worth It?

Stenn can be a great resource if you need capital to scale your e-commerce or SaaS company. Many businesses in these verticals require access to substantial capital in their early stages and may not have the financial flexibility to cover fixed monthly payments. Stenn can help businesses get off the ground by providing the capital they need to take the next step.

How to Get Started with Stenn

You can get started with Stenn by submitting this simple online form and creating your account to provide your business details. Connect your accounts to see how much money you can get.